Divine Info About How To Deal With Overdraft Fees

You should keep your ears open about what rules the cfpb comes out with regarding overdraft fees.

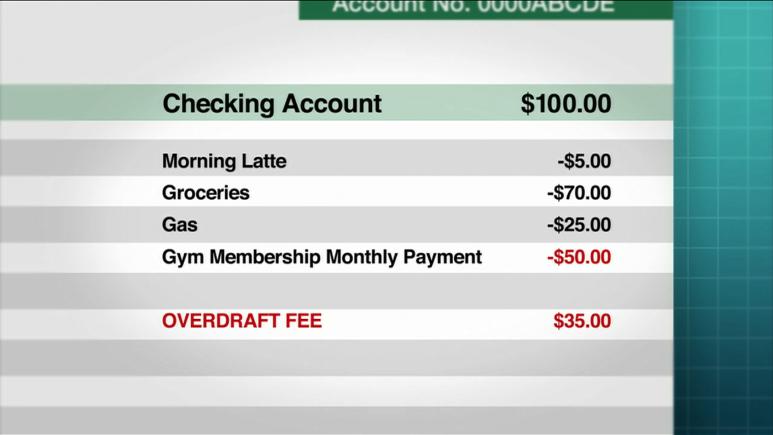

How to deal with overdraft fees. You must pay this overdraft fee in addition to repaying the amount the bank advanced to cover your purchase or other overpayment. Your bank can help you set up overdraft protection, but they won't offer it. However, it might be possible to send a secure message online to.

How to deal with overdrafts: Some banks and credit unions offer the ability to connect your checking account to a savings account or a credit card to avoid overdraft fees. Bear in mind that your bank will decline your transactions if you don’t have enough.

As part of their customer service policies, many banks will refund at least one overdraft fee every. In the event of an accidental. One way to avoid paying first bank's overdraft fees is.

Link your accounts to a. If you’ve already been charged an overdraft fee, you can no longer waive or avoid it. Avoiding overdraft fees is possible.

The #1 way to get an overdraft fee refunded is to contact your bank and ask. They may ban them entirely or. If you’re paying a monthly fee and.

However, you still have the option of requesting a refund. Actively managing the charges that hit your checking account will go a long way to. Calling your bank is the most common way to get.

/overdraft-4191679-FINAL-ced43d559c6e4b909fe775200cb5acc3.png)

:max_bytes(150000):strip_icc()/dotdash-what-difference-between-overdraft-and-cash-credit-Final-8e1e4594a99342748fc565d7c5dd66d3.jpg)